Investing with purpose is a hot topic in the financial world. And yet the process for conscious investors to find and choose sustainable investment products remains complex.

This article is designed to simplify your understanding of sustainable investing by comparing its two most prevalent product types: ESG products (Environmental, Societal, and Governmental) and Impact investment products.

Examining ESG investments and impact investments

ESG

ESG products make use of a scoring system. The system assigns each company in a portfolio a score that assesses the extent to which it integrates environmental, social, and governance aspects to its manufacturing processes. This assessment is limited to the behavior of companies and does not include an analysis of their business operations.

More explicitly, the ESG score measures how well the company compares with others. This is based on:

- How well environmental criteria are accounted for in production processes. E.g. compensating for carbon emissions, having a no-paper policy, or a waste reduction policy.

- Tackling social issues like gender equality, decent working conditions, client and supplier relationships, as well as contributing to local communities.

- Governance and leadership: how shareholders are handled, as well as executive pay, internal controls, or audits.

Using these three indicators, ESG funds typically rank companies and exclude the “bad pupils” from their products, based on the different criteria they choose.

ESG scores can be very different from one rating provider to another as different frameworks, indicators, metrics, data, qualitative judgment, and weightings can be used to find the “best in class”.

Does this mean that ESG products are certainly doing good for the planet?

No. But they are doing their best to positively affect the planet, people, and governance.

Impact investment

Because impact investment products have developed significantly in recent years. Because not everyone shares the same definition, it’s important that we clarify them.

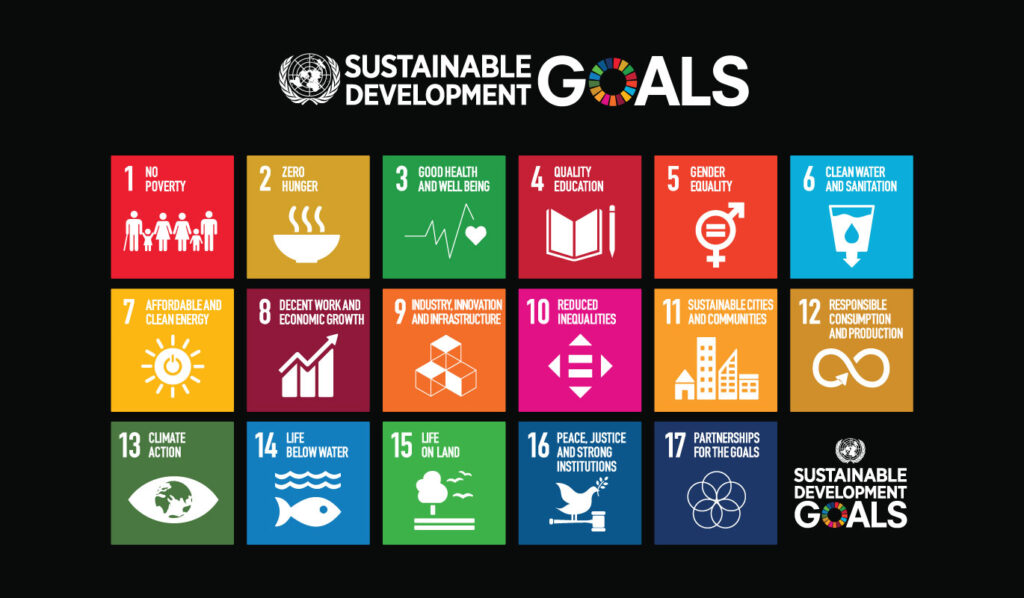

Impact investment funds judge companies on the absolute good that their products or services contribute to the planet. Therefore impact investments are often evaluated with the United Nations’ Sustainable Development Goals.

Exemplary impact companies are those that produce goods designed to address environmental issues, like recyclable solar panels. Similarly, they can address social issues, such as providing microfinance services in emerging markets.

The goal is not only to do good but also for it to be economically sustainable.

Whereas ESG strategies are typically limited to the single objective of generating ethical investment performance, impact strategies go much further, pursuing the dual objectives of financial returns and positive contribution.

Impact investments require a return target and intentionality

Intentionality is a mandatory part of any impact investment. It must make a transformational contribution to a predefined issue -such as decarbonization, pollution reduction, inclusion, or diversity. Impact investment funds aim to identify companies that produce goods and services that contribute to solving these problems, and to do this, they analyze companies’ revenues to determine the absolute and relative share of revenues that generate a positive impact on each predefined goal. This analysis results in a score or contribution that can be used to identify all companies that generate a positive impact – including companies with multiple business lines. Funds then use this impact score to determine which companies they include in their products.

Whereas ESG strategies are typically limited to the single objective of generating ethical investment performance, impact strategies go much further, pursuing the dual objectives of financial returns and positive contribution.

Measurability is mandatory for impact investments

A high impact score isn’t enough to validate a company’s impact on its goal. Likewise, ESG criteria aren’t enough to quantify this, either… Thus, it’s possible to find companies with very high ESG scores whose operations harm the environment and health.

In conclusion, ESG funds are distinctly different from impact funds.. When selecting “sustainable” investment products, investors should consider what matters the most for them -either the quality of operations and/or the final contribution being made to society.

In another article, we’ll see how impact investing can be measured and what methodologies exist.

Remark : this article has been written in collaboration with Asteria Investment Managers.